While most of my articles here are about quantitative methods and models, I am always trying to follow media updates about how Mr. Market and the economy are going. We have reached a level of communication where everything that is online has a huge effect on people’s decision making, up to the point that a simple Reddit thread can harm hedge funds.

In 2023 the spotlight was on interest rates, with many websites and podcasts constantly discussing how the FED decisions were affecting the market. I decided to do my own research about these topics and stumbled upon a very interesting article written in 2016 by S&P Global directors Fei Mei Chan and Craig Lazzara about the effect of interest rates on equity performance. Using data between 1990 and 2015 their analysis suggested that there is no evidence to support the general belief that equity returns are affected by interest rates cycles. I’m not an economist nor a finance specialist, but with the existing expectation on the following FED moves, I decided to replicate part of their study testing my own assumptions and hypothesis. The script developed to the analysis is in my Github.

Disclaimer: This article was developed for informational purposes only, it is not an investing recommendation.

Theoretical Basis

The conventional wisdom is build upon the premises that companies expected earnings and expected growth are strong price drivers. As a direct effect, the increase in interest rates translates into a higher cost of capital that companies use to finance their growth. As an indirect effect, it increases the discounts of expected future earnings in a common equity valuation model, and reduces the shareholder risk-premium, what might drive equity investors to fixed rate assets. The theory makes a lot of sense but both the corporate finance and the market systems are much more complex than that. The number of variables involved in this puzzle, associated with emotional and cognitive factors of investors is what makes the financial system so fascinating. So my main question is, can we find a direct, first-order relationship between interest rates and equity market returns?

The Data

The first important decision of the study is the choice of metrics to represent interest rates and the market. The original article references the 10-Year U.S. Treasury Yield and the S&P500 respectively.

As you might know, the S&P500 is a capitalization-weighted index and there are many interesting discussions about survivorship bias in such index family. So before writing this article I replicated the same analysis to different indexes, including the S&P500 Equal Weight, and the general results were similar. I also tested different interest rates metrics and obtained no significant difference. Because of that I decided to present the results using the same original references.

As presented in the chart below, the 10-Year U.S. Treasury Yield faced a long upward trend between the 60’s and the 80’s, and a major downward trend ever since. Despite that, there were windows of ups and downs in both periods, depending on the overall sentiment about the economy at that time.

The monthly change, usually measured in basis points (bps), had moments of higher and lower deviations, as we can see in the chart. This is good since it allows our study to check the potential relationship in terms of both direction and strength.

Analysis

I decided to add a few steps in the analysis method proposed in the original study. Besides comparing monthly rates change with monthly market returns, I analyzed also the data in rolling windows of 3, 6, 12 and 24 months. My assumption is that if a direct relationship exists between both variables, longer term rates changes can make it more visible.

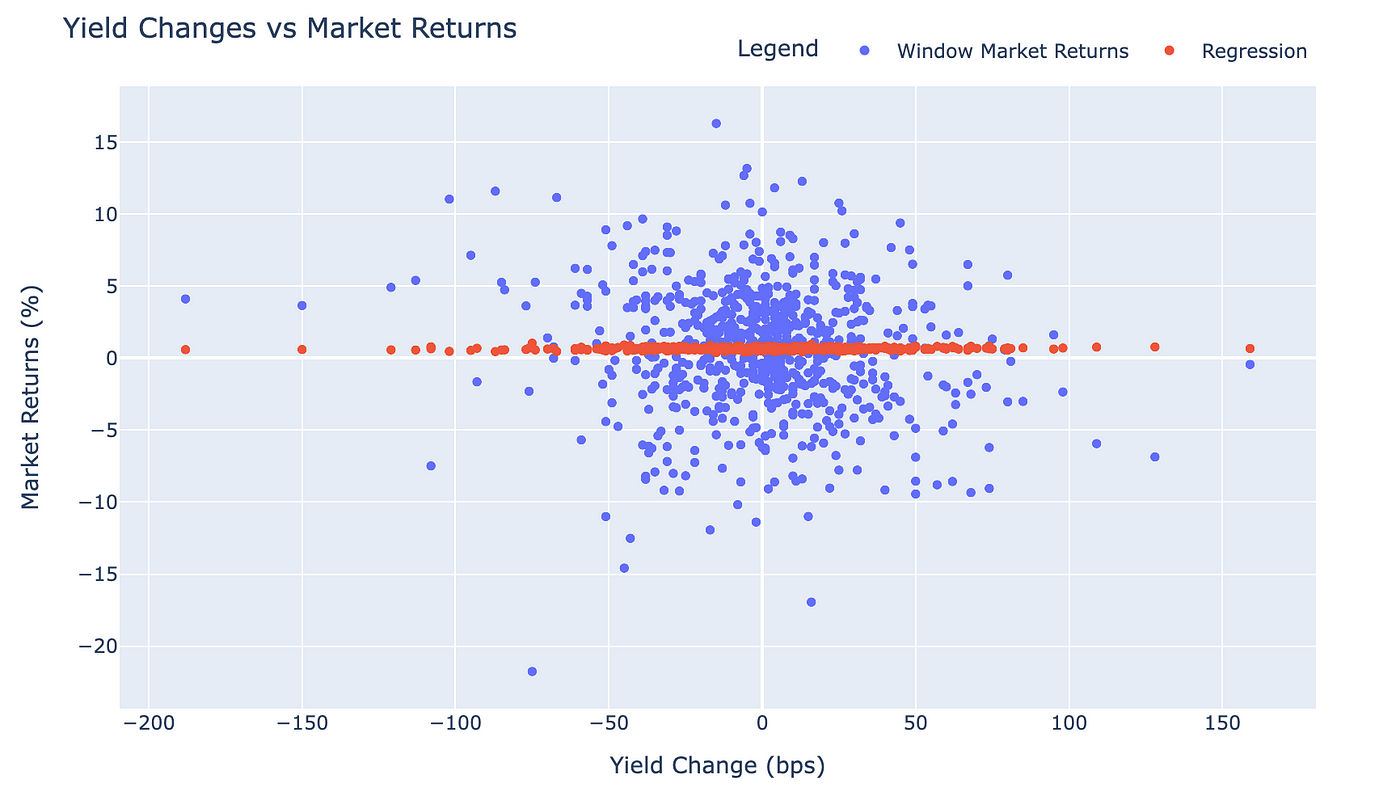

Below you can see the comparison of yield changes vs market returns of each monthly window using data from 1962 until 2023. The dispersion of data points is an indication of weak (if any) relationship. I also performed an OLS regression of both variables, which returned negligible values of r-squared and beta. In fact, the p-values obtained by the regression t-test and F-test were below 5%, which would be enough to consider a relevant explanatory power, but with such a small coefficient, it is hard to consider those results reliable or useful from a practical significance perspective.

As presented in the charts below, testing in longer windows resulted in the same pattern as well. Seemingly neither the direction nor the strength of the yield change resulted in specific values of market return.

The preliminary results match with the findings in 2016, but in my opinion a second analysis was missing. My hypothesis was that, if rates changes have an effect in companies’ growth, debt and earnings, a time lag is necessary for these consequences to actually reach companies’ balance sheets. As with any economic variable, maybe the response would take some time to show up and impacts the market. So I decided to compare the rates change of one window with the market returns of the following window. For example, a yield change in the month of February is plotted with the market returns of March. Below you see the comparison between monthly window yield changes and the following monthly market returns.

Extending the window size did not result in different conclusions, as we can see in the different plots.

Finally, I felt like a third theory could be tested. If the equity markets is always trying to anticipate future happenings, maybe prices were responding prior to the yield curve. Usually the 10-Year Treasury Yield already reflects market expectations, but I felt like it was worth the shot. I applied the same method as above, but instead of using the following window I compared the yield change with the previous window. As you can see below, the observed pattern was the same as in the previous tests.

The presented results were obtained using the entire available data series, but I also repeated the analysis with smaller lookback windows of 5, 10, 15, 20 years and more, and obtained similar results.

What Rising Rates Did Do (So Far)?

The most recent FED Funds Rate rising cycle started in early 2022. Taking January 1st as a reference the FED rate increased by more than 5%, and the 10-Year Treasury Yield increased by more than 2%. During that period, the S&P 500 decreased by nearly 25%, and has recovered almost entirely from that drawdown up to today (December 2023).

From both a visual and a mathematical standpoint, there is not much predictive power between the market returns and the short or long term rates. In other words, while there might be some causal relationship between the events, it is far from being a strong first-order effect. Based on this, building equity strategies that are triggered by or rely on changes in interest rates might be tricky and can lead to losses. While the theory behind the belief is very beautiful and makes sense, it is important to identify strong evidences in data to validate it.

Conclusion

Based on the analyzed data I agree with the general conclusions of the original article. There is no evidence in data that changes in interest rates have a direct, first-order effect in equity returns. In my analysis I tested different interest rate and market references, different lookback periods, and different grouping windows. My opinion is that a more complete study could test the actual relationship between interest rates and companies’ earnings in the past, and also the effect of interest rates’ Nth-order interactions on market returns. If you are interested in the topic, I also strongly suggest reading the original paper, which also discusses the effect of interest rates in Index Dispersion and Factor-Based Strategies.

Thank You!

Thank you for reading this material, I hope it can be useful for you in some way. If you want more details on the analysis steps you can check the script in my GitHub or reach me out in LinkedIn!

Reference

Fei Mei Chan and Craig J. Lazzara — “What Rising Rates Won’t Do” — April 2016

Diego Pesco Alcalde

Diego Pesco Alcalde

Founder and Consultant at Metrica.